Auto Dealer financing and directly approaching a bank for a car loan? Buy Here Pay Here Near Me

Canadian Auto Brokers Helps Canadians Get Better Car Loans with Lower Rates, Lower Payments and up to $30,000 Cashback. There are several ways to purchase a new car. Two of the more common choices are to apply for a bank loan or finance the vehicle directly through a dealership. Although both options involve a similar payment process, each has.

Great City Cars Blog Buy Here Pay Here Columbus Ohio Great City Cars

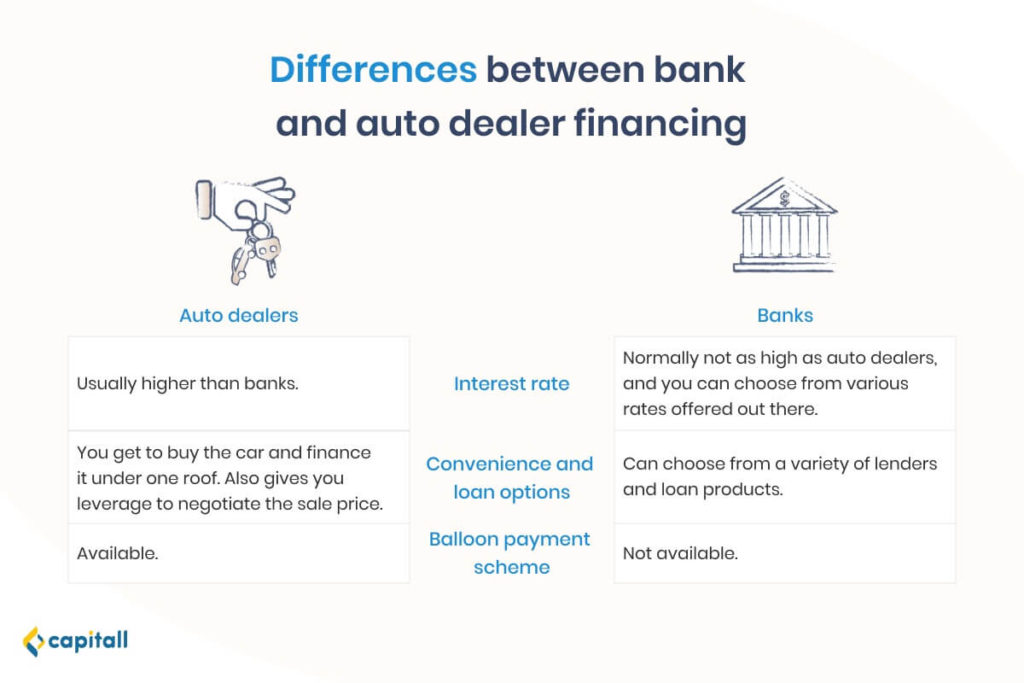

Dealerships might offer extra incentives, like a 0% interest rate for a shorter period. Sometimes dealerships will offer financing to buyers with lower credit scores. The dealer might give you extra incentives for using their financing, like a 0% interest rate, typically for a shorter period, or discounts on optional features for your car, such.

Auto Deals

When I came to Canada, I bought a new Nissan and the dealer offer 0% financing or 3000$ if I'd pay cash. So the 0% wasn't really 0% financing. the dealer will most likely always approve you, the question is at which rates and if they're offering you the best price on the car.

Car Loan Type. Bankoffered Financing of Buying New Automobile Stock Vector Illustration of

Here are some pros and cons of financing directly with a lender: Pros: May help you get the best interest rate for your circumstances. You can contact different lenders and compare interest rates. Shopping around may help you get the best interest rate for your credit situation. May save you time at the dealership.

Futurestep Finance Home Loans Mortgage Broker Futurestepfinance

However, to get an idea of bank car loan interest rates, download the TD Wheels app, which lets you browse new cars and financing offers. As of April 2, 2024, TD is showing the following car loan interest rates: 2024 Toyota Corolla: 8.99% for 24 - 96 months. 2024 Honda Civic Sedan: 8.99% for 24 - 96 months.

Lease or Finance a Car Which Is a Better Option?

January 27, 2012. Bank car financing is often better than car dealership financing when you are buying a car, particularly a used car. However, there are some occasions when dealership financing can be a good option, particularly for people with excellent credit. In order to properly find the right financing for your vehicle purchase, be sure.

Financing a Vehicle Mazda Canada

The Pros. Dealers can offer more options, potentially through the auto manufacturer's financing division, an independent loan provider, or the bank they use for their business. The vehicle and the financing are all in one place, speeding up the process. Since the dealer makes profit on the vehicle and commission on the loan, there's.

american national bank car loan rates

Buying a car with a personal loan involves borrowing the funds from a bank, building society or other lender, so the dealer has no involvement in financing and you effectively become a cash buyer.

Getting a car loan bank financing or dealer financing? LowestRates.ca

Financing a New Car. If shopping for a new car, it is worth it to at least look into dealer financing. Dealers offer incentives on new car purchases, and in some cases even offer 0% financing. This is something that you would never get on a used car. If shopping for a used car, then it makes sense to look at bank and dealer financing to.

Bank Vs. Dealer Financing Which Car Loan Option Is Better For You?

Visit your dealer and ask for Scotiabank financing. Still have questions? Call us. 1-888-777-6842. View legal footnotes. Are you looking for car financing options? Scotiabank Auto Loans can help you bridge the step between you and your upcoming car purchase. Calculate car payments now.

Car Loan In Singapore Borrowing From A Bank Vs An Auto Dealer Capitall

You might find a bank offers a better annual percentage rate (APR) than dealer financing, and you can lock in that interest rate for a set time, on average 30 days. This takes some of the pressure off you as you shop. A bank loan can typically be used if you plan to buy a used car from a private seller.

Car Finance Vs Bank Loan Which Is Better National Loans

How loan approvals work: banks vs. dealerships. Car loans are typically secured loans. The debt is guaranteed by an asset (the vehicle), meaning if a borrower fails to make their agreed-upon regular payments, the lender - whether it's the bank or a dealership - can have the vehicle repossessed. Both banks and dealerships will want to.

Bank of Maharashtra Car Loan at affordable Interest rates Avail Car Loan at 7 PA

Car loans with a dealership. Most dealerships make car loan arrangements for you with a lender. In this case, you apply for and receive a car loan directly at the dealership. When you visit the dealership, dealers arrange financing for you with: a financing division of the car manufacturer. a financial institution, such as a bank or credit union.

Bank Car Loans vs. Dealer Financing

Financing a Car Through a Dealership. Dealer-arranged financing works a lot like bank financing—the only major difference is that the dealer is doing the work on your behalf. After you choose your vehicle, the dealer will have you fill out a credit application, which they'll submit to multiple lenders. This allows you to compare rates and.

Marielle Duffy

Documentation fee - Similar to banks, around $50-$100 for paperwork. Dealer preparation fee - For getting a vehicle ready for sale, averages $500-$800. Disposition fee - Added cost for the dealer to arrange financing, ranges $300-$700. Both options also charge penalties for late payments.

Personal Banking Savings Accounts Banking Canara Bank Instant loans, Loan, Car

The same loan from a bank came with an interest rate of 6.90 percent. Once you have preapproval from a bank, you can go to the dealership and shop for the car you want. When you apply for.

- ملخص كتاب العادات السبع للناس الأكثر فعالية Pdf

- Cabins For Sale At Emma Lake

- Bouncy Castle Rental Red Deer

- Homes For Rent In Cold Lake Alberta

- Tales Of The Grotesque Toronto

- House For Rent In Okotoks

- Logement à Louer Avec Vue Sur Le Fleuve

- Gluten Free Chinese Food Victoria

- Le King Des Joe Connaissant

- Tex Mex Casserole Oh She Glows