Texas Repossession Laws Car Repossession Bankruptcy

Car repossession laws vary slightly depending on your province of residence. In Ontario, the lender has the right to seize and sue for any overdue payments that are on the loan. In Alberta and British Columbia, there is a seize or sue law, whereby the lender can either repossess your car or sue you for the overdue amount.

car repossession laws in vincevanorden

The Ontario repossession lawyers at Wadhwani & Shanfeld can assess your situation and help you get your car back. To learn more, schedule a consultation. Call our office at (800) 996-9932. An Ontario repossession lawyer can assist you with a wrongful vehicle repossession, contact Wadhwani & Shanfeld today.

What To Do When Your Car Is Repossessed In Malaysia?

Vehicle Recovery Services. Repossession and Recovery. Our bailiffs act on behalf of registered lien claimants to repossess vehicles for unpaid leases, loans, or repairs. This includes all types of vehicles, from motorized scooters to 18-wheel tractor trailers. Pursuant to the Personal Property Security Act, R.S.O. 1990 (PPSA) and the Repair and.

Statute of Limitations on Car Repossession in Kentucky Louisville

If so, you could file for bankruptcy in Ontario, or file for a consumer proposal. This will immediately stop the creditor from being able to garnish your wages, though they would still be able to repossess your car. Furthermore, many auto loan companies are installing what is known as a starter interrupter (a GPS-equipped black box) into the.

Statute of Limitations on Car Repossession in Kentucky Louisville

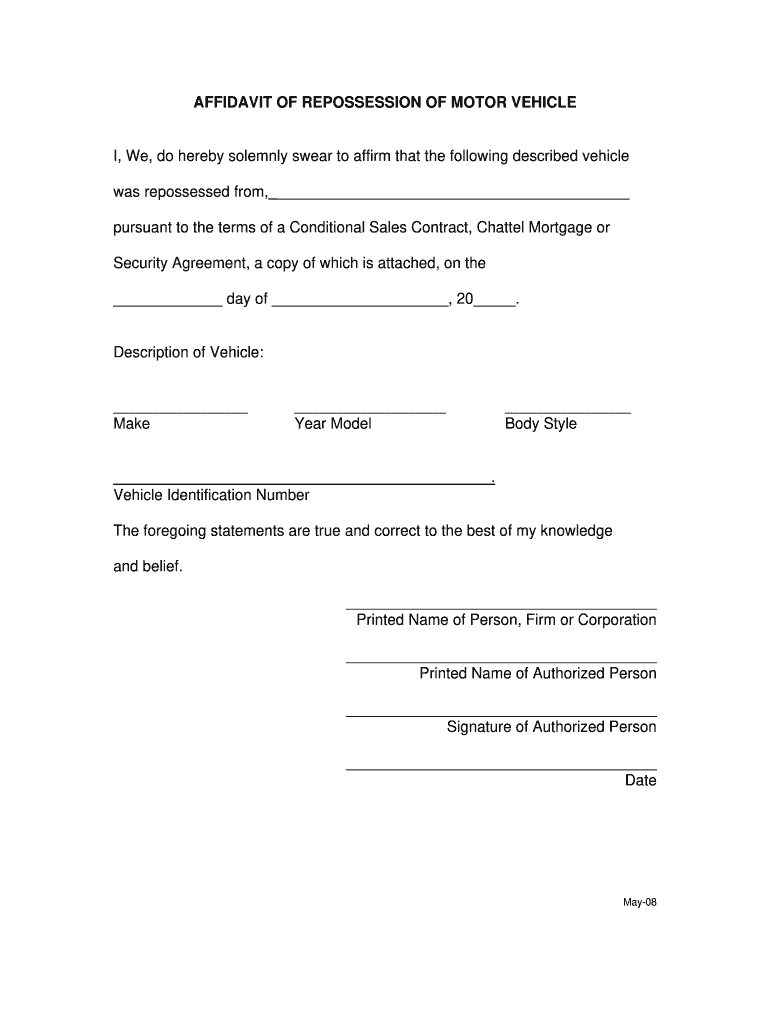

Step 1. Pay off the arrears to "reinstate" the agreement. If your property is repossessed by a secured creditor, you have the right to reinstate the agreement by paying off what you owe. (That is as long as the property is consumer goods.). To reinstate the agreement, you must pay off the arrears on the debt and the expenses of repossessing the property. . (Arrears are payments that are due.

Vehicle Repossession In Canada How Car & Truck Repossession Works

The Complex World of Ontario Repossession Laws. Repossession is a topic that many people find daunting and confusing, but understanding the legal framework surrounding repossessions in Ontario is crucial for both creditors and debtors. In this blog post, we will explore the intricacies of Ontario repossession laws and provide valuable insights.

Stop Car Repossession in Illinois DebtStoppers

Canadian Laws for Vehicle Repossession. There is no consistency in the repossession laws in Canada because each province has its own laws. There are some provinces that allow a lender to repossess the vehicle and sue the debtor for damages, while others only allow the vehicle to be repossessed by a lender. For that reason, if you are late with.

Car Repo Laws In Illinois Protecting Your Rights

In Ontario, car repossession is a legal process whereby lenders can reclaim vehicles from borrowers who have failed to make payments on time or in full. Generally speaking, it requires the lender to obtain a court order for repossession and then hire a bailiff or repo agent to seize the vehicle. The borrower must be given proper notice.

Car Repossession & Your Rights Under Wisconsin Law Hawks Quindel Website

Vehicle repossession has severe financial repercussions in addition to the loss of your transportation. How Car Repossession Works in Ontario. The regulations governing car repossession differ widely depending on where you live. The lender in Ontario has the power to seize and sue you for any overdue payments on the debt.

Vehicle Repossession by State — Hot to Stop It Personal Finance Before It's News

Car repossession law in Ontario is a complex and important aspect of consumer rights. It governs the legal rights and responsibilities of both borrowers and lenders when it comes to repossession of vehicles due to non-payment or default on a car loan. Understanding these laws is crucial for individuals involved in car financing transactions to.

car repossession laws in trinidadgambee

What is repossession. Repossession can happen whether you finance or lease your vehicle. In the case of a leased car, the dealership or auto seller retains ownership of the vehicle. You signed a contract or lease agreement with terms allowing the leasor to seize the vehicle if you fail to keep up with your monthly lease payments.

Notice Of Repossession Letter Template Great Professionally Designed Templates

This is not the case in Ontario. In Ontario, the creditor has the right to seize and sue for the balance remaining on the loan. While repossession laws vary between provinces, the types of vehicle repossession are consistent across the country. There are two types of repossession include involuntary repossession and voluntary repossession.

What you must know about Car Repossession

Salman said he found a used Mercedes Benz on Kijiji and came to Toronto to buy the car in a private sale in December of 2019. Just as the deal was closing Salman said the seller mentioned there.

Car Repossession in Texas Repossession Laws 2024

Is car repossession different in each province? Yes, the legal process you will experience depends on your province. Some regions have a "seize or sue" law, whereas others, like Ontario, have "seize and sue" laws. Essentially, "seize or sue" means the lender can decide to repossess your vehicle or sue you for the debt owed. You can.

zitafromberg

Voluntary. One type of repossession that occurs in Canada is a voluntary repossession. In a voluntary repossession, a consumer may recognize that he cannot afford to continue making car payments. The consumer may decide it makes the most financial sense to simply return the car to the creditor to avoid any prolonged collection efforts.

How Many Car Payments Can You Miss Before Repossession? Self. Credit Builder.

In Ontario, car repossession laws grant lenders the right to reclaim a vehicle if the borrower defaults on payments. The process involves legal steps to ensu.