Pay Off a Loan Early to Help Credit and Save On Interest Compare Companies Online

Debt avalanche. With a debt avalanche, you pay off your loan with the highest interest rate first. Once your highest interest rate debt is paid off, you move on to the next-highest interest rate.

How to Pay Off Your Car Loan Fast (Pay It Off Early) Car loans, Paying off car loan, Money

"Putting the loan on autopay at a rounded-up payment amount or making biweekly payments when you get paid - instead of monthly - are easy ways to pay down the loan early," Nitzsche says.

Does Paying Off a Loan Early Hurt Your Credit? Self. Credit Builder.

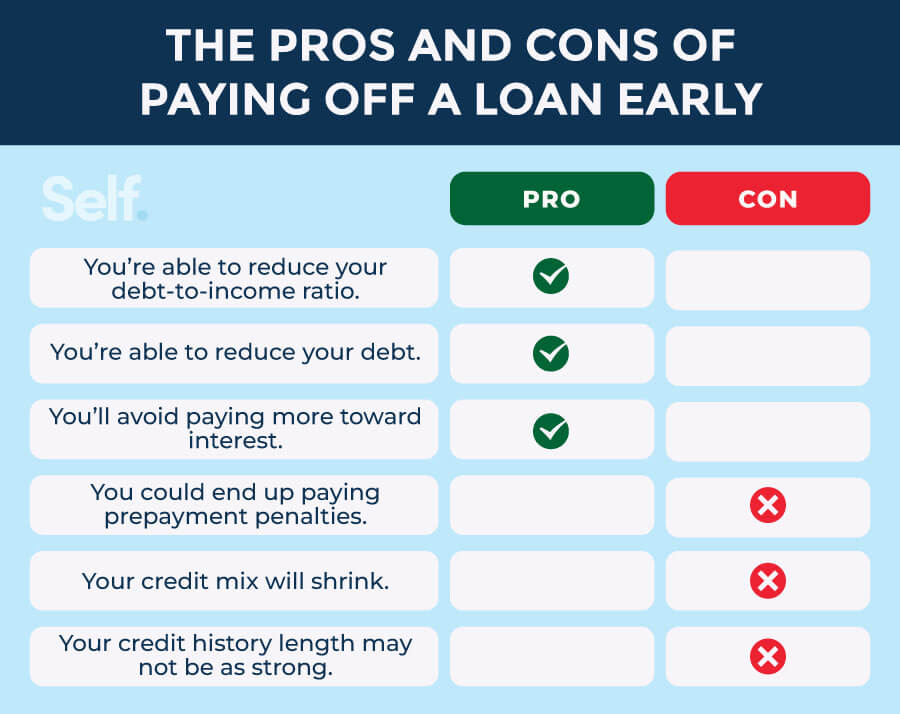

Opting to pay off a personal loan ahead of schedule could potentially have a positive impact on your debt and credit. You might save money on interest The sooner you pay off your loan, the less you'll have to pay in total interest. If you have an interest-bearing loan, this means less daily simple interest will accrue.

How to Pay Off Your Home Loan Early in 2021 Home loans, Loan, How to run longer

5. Pay Biweekly. One way to pay off your mortgage early that doesn't require coming up with any extra payments is to split your monthly payment into two smaller payments and paying biweekly.

3 Types of Loans to Pay off Debt

Yes, you can pay off a personal loan early. But some lenders do charge a prepayment penalty if your loans are paid off before the term ends. Prepayment penalties can vary by lender, and can be a percentage of the outstanding balance or a fixed fee. If you find yourself in a position to either make additional loan payments or pay your loan in.

Save LAKHS by Paying Loan Off Early! Loan Repayment vs Investing! Ankur Warikoo Hindi

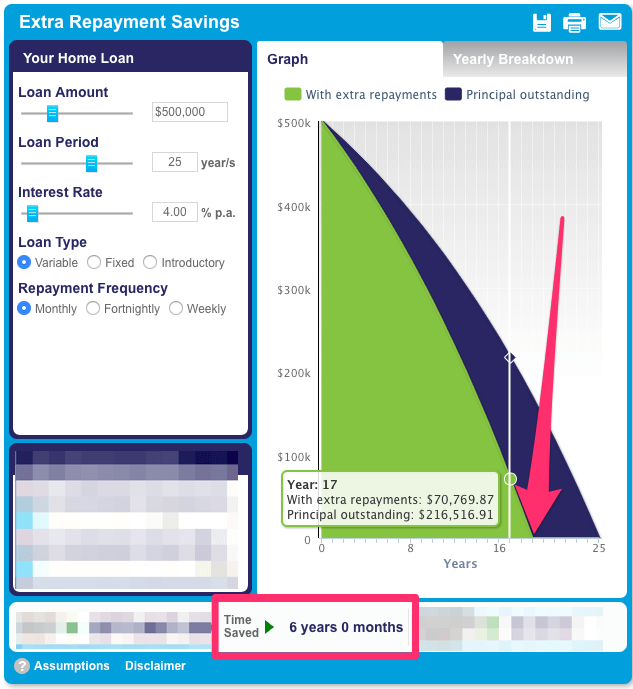

If you use an online loan calculator, you can see how changing the payment amount will help you pay off a loan faster and save you money. For example, using Investopedia's online calculator, you.

5 Effective Ways to Repay a Loan at Ease Fibe

5. Build your savings. One of the most significant advantages of paying off debt is the spare cash you will now have available to address other financial goals and priorities. Especially during.

5 Top Secrets How To Pay Off Home Loan Early YouTube

KEY TAKEAWAYS. Pay on time and don't miss payments. Talk to your lender if you have any difficulties. Educate and protect yourself. An installment loan is a loan for a specific amount that you get from a lender such as easyfinancial that you agree to pay back, with interest, over time with scheduled payments.

What Happens If I Pay Off a Loan Early? Consolidation Expert

If you pay off the personal loan earlier than your loan term, your credit report will reflect a shorter account lifetime. Your credit history length accounts for 15% of your FICO score and is.

Pay Off Your 30 year Home Loan 6 Years Faster 🎉 [10 Easy Tips] Easy!

Let's say you sign a five-year, $10,000 personal loan at 7% interest. If you pay an extra $100 a month on your loan, you can save yourself about $719 on interest compared to sticking to your.

Paying Off a Loan Early Pros & Cons

For instance, paying off the $10,334 personal loan in 18 months instead of 36, would result in $700 in savings, even if a 2% prepayment penalty is assessed. Paying off a personal loan early comes.

Paying Off Car Loan, Pay Off Mortgage Early, Debt Payoff, Personal Finance Advice, Personal

Early Loan Payoff Calculator for Calculating Savings with Extra Payments. This early loan payoff calculator will help you to quickly calculate the time and interest savings (the "pay off") you will reap by adding extra payments to your existing monthly payment. The calculator also includes an optional amortization schedule based on the new.

Five Ways to Pay Off a Loan Early United Texas CU

ultimatemandarinxo. I (26/F) took a $8500 loan from Easyfinancial. Worst decision of my life! Last year, my husband lost his job and my maternity leave was coming to an end. We had just moved into a new apartment. We were tight on money and our credit score is low so we wouldnt qualify for a bank loan. I decided to look around to see if I would.

2 reasons to not pay off your loan early Secured Advantage Federal Credit Union

Selling unused items. 6. Think about refinancing your loan. Finally, another way to potentially pay off a loan early is by refinancing your debt. Refinancing allows you to take out a new loan, ideally one with a better interest rate and more favorable loan terms, and use it to replace your old one.

Should You Pay Off a Personal Loan Early? Match Financial

How to pay off a mortgage early. Paying off a mortgage early requires you to make extra payments, but there's more than one way to approach it. Here are some specific ideas: Use the 1/12 rule.

How to Pay Off Your Home Loan Early in 2021 Home loans, Loan, Debt free living

Here's a look at the red flags you should take stock of before proceeding: Potential for steep interest rates. Interest rates for secured loans start at 9.99% and go up to 25.99%, while unsecured loans come with interest rates from 29.99% up to 46.96%. Potential for additional charges.